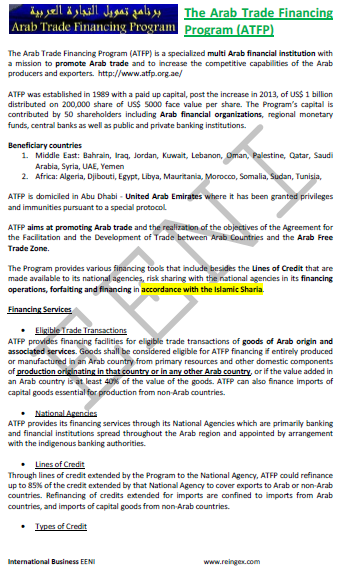

Arab Trade Financing Programme (ATFP) Emirates

Arab Free Trade Zone. Financing, Islamic Sharia. United Arab Emirates

Financial institution (Arab Development Funds): Arab Trade Financing Programme (ATFP).

- Main objective is to promote intra-Arab trade

- Support to the Arab Free Trade Zone

- Financing tools in accordance with Islamic Sharia: financing, forfeiting, lines of credit

- Introduction to the Arab Trade Financing Programme (UAE)

- Intra-Arab Trade promotion

- Support for the Arab Free Trade Zone

- Financing tools in accordance with Islamic Sharia

Sample - Arab Trade Financing Programme (ATFP)

Religions and Global Business -

Religious diversity

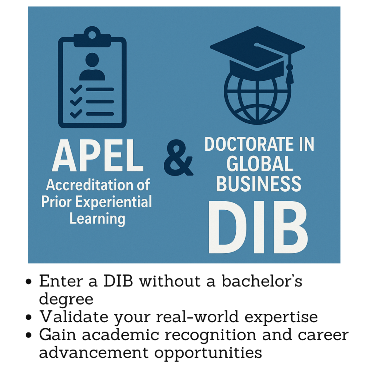

The Subject “Arab Trade Financing Programme (ATFP)” is included within the curriculum of the following academic programs at EENI Global Business School:

Master: Religions & International Business, International Business, Business in Africa.

Doctorate in African Business, Ethics, Religion & Business.

Languages:  (

( Financement Commerce Arabe

Financement Commerce Arabe  Financiación comercio árabe

Financiación comercio árabe  Organization of Islamic Cooperation).

Organization of Islamic Cooperation).

- Created in 1989 in Abu Dhabi (Emirates)

- The Arab Trade Financing Programme is the promoter of the Intra-Arab Trade Information Network (IATIN)

- The eligible Products and services should be considered as “Arab origin” (entirely manufactured in an Arab nation, or 40% of the local added value)

- Import finance of capital goods

- Pre-export and import credits

- Post-shipment credits

- The Arab Trade Financing Programme (ATFP) is a Muslim fund of Islamic Civilization

The Beneficiary countries of the Arab Trade Financing Programme are:

- Africa: Algeria, Djibouti, Egypt, Libya, Morocco, Mauritania, Sudan, Somalia and Tunisia

- Middle East: Bahrain, Iraq, Jordan, Kuwait, Lebanon, Oman, Palestine, Qatar, Saudi Arabia, Syria, the Emirates, and Yemen

Related information

- Arab Bank for Africa (BADEA)

- Arab Fund for Economic and Social Development

- Arab Monetary Fund

- Influence of religion on financial systems

- Arab Gulf Programme

- Islamic Development Bank

- OPEC Fund for International Development

- Abu Dhabi Fund for Development

- Kuwait Fund for Arab Economic Development

- Saudi Fund for Development

(c) EENI Global Business School (1995-2025)

Top of this page

WhatsApp

WhatsApp