African Value Chains. Transport Costs

Opportunities for African enterprises (Value Chains) Export and Transport Costs in Africa

Transport in Africa, African Economic Integration

Regional Integration in Africa should facilitate African Value Chains, both for regional and global market.

The African Development Bank estimates that the cost to transport a container from Durban (South Africa) to Lusaka (Zambia) - 1,633 kilometers/ 1,015 miles- are USD 8,000, and 1,800 from Durban to Japan!.

- Introduction to African Value Chains

- Opportunities for African companies

- African Growth Poles

- How African enterprises can take advantage of value chains?

- Case Study: Cocoa Value Chain in West Africa

- Rules of Origin and transport costs

- Export costs in Africa

- Trade Facilitation

- One-stop border post

- FDI Cooperation

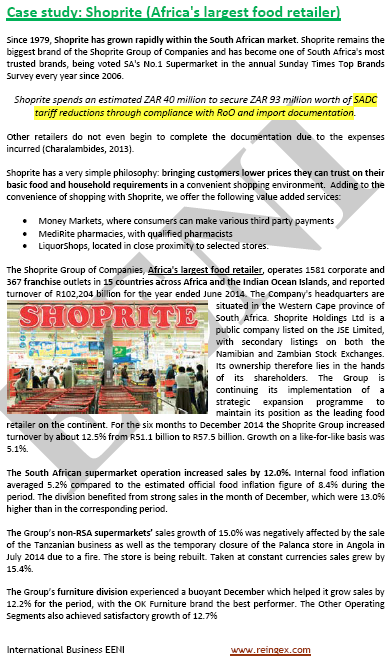

- Case Study: Shoprite (the African largest food retailer)

Sample - African Value Chains:

The educational aims of the Subject “African value chains” are the following:

- To learn how intra-African trade can benefit from African value chains

- To assess the importance of One-stop border post in Africa

- To analyze the impact of African Value Chains on transport and export costs in Africa

- To study success stories of African Value Chains (Egyptian textile sector, cocoa value chain in West Africa...)

The Subject “African Value Chains” is included within the curriculum of the following academic programs at EENI Global Business School:

Masters: Transport in Africa, Business in Africa.

Doctorate: Global Logistics, African Business.

Languages:  or

or  Chaines Valeur Afrique

Chaines Valeur Afrique  Cadenas de valor africanas

Cadenas de valor africanas  Cadeias de valor africanas.

Cadeias de valor africanas.

- Regional Trade and cross-border investments are a key factor for Value Chains development in Africa

- The role of the Regional Economic Communities is critical, by ex. reducing Technical Barriers to Trade (Rules of Origin) in Africa

- In some African Countries (South Africa, Egypt, Morocco, Ethiopia, Kenya or Tunisia), enterprises are improving their value addition in several sectors

The Regional Economic Communities are working in Trade Facilitation programs, but trading cost in Africa is not competitive in many cases.

There are good examples of improving African Value Chains. By example...

- The Cocoa Value Chain in West Africa (mainly in Ghana and Ivory Coast, the World's largest cocoa exporter), has increased from 12% (2000) to 18.6% (2013), by liberalization and incentives programs (economic free zones), attracting the foreign investors

- Today more than 1 Million people in Ivory Coast and 800,000 in Ghana work in the Cocoa Sector. Local farmers are receiving a fixed price (70% of FOB price)

- Egyptian textile sector has substantially increased his value addition, and today contributes to 27% of Egyptian total production

- According to the African Development Bank, the One-stop border post can help to reduce clearance times (Customs Procedures) at the borders. By example, between Uganda and Kenya (Malaba), the border-crossing time has been reduced from 24 hours (2011) to 4 hours (2012)

- In Chirundu (border post Zimbabwe - Zambia) the One-stop border post, part of the North-South Logistics Corridor, the time for cross the border for lorries has been reduced from 3 days to 2 hours

Sample - Shoprite (African largest food retailer)

South Africa:

(c) EENI Global Business School (1995-2025)

Top of this page

WhatsApp

WhatsApp