Customs Convention on Containers (CCC)

Facilitate temporary admission of merchandises (Customs Convention on Containers)

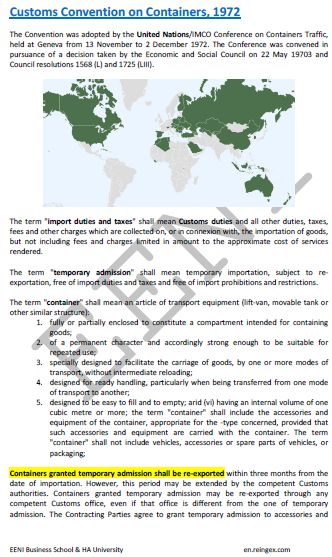

The Customs Convention on Containers (CCC) was adopted by the UN Conference on Container Traffic, held in Geneva from November 13 to December 2, 1972.

The main objective of the Customs Convention on Containers is to facilitate temporary admission of goods in a country.

Under the Customs Convention on Containers is understood as temporary admission, temporary importation with tax and import duties exemption.

- Introduction to the Customs Convention on Containers (CCC) / United Nations

- Container marking requirements

- Temporary admission facilities contemplated in the Customs Convention on Containers

Sample - Customs Convention on Containers (CCC):

The Subject “Customs Convention on Containers (CCC)” is included within the curriculum of the following academic programs at EENI Global Business School:

Logistics Courses: International Transport, Maritime Transport, Multimodal, Road, Rail, Air, Transport and Logistics in Africa.

Certificate in International Transport

Masters: International Transport, Transport and Logistics in Africa.

Languages:

Convenio Aduanero sobre Contenedores (CCC)

Convenio Aduanero sobre Contenedores (CCC)

Convention douanière relative aux conteneurs

Convention douanière relative aux conteneurs  Convenção Aduaneira relativa aos Contentores.

Convenção Aduaneira relativa aos Contentores.

Taxes and import duties are understood to be all those Customs, taxes, or any other type of tax applied by the customs when the merchandise is imported.

Under the Customs Convention on Containers (CCC), temporary admission is granted to containers, whether or not they are loaded with Products.

Contracting Parties to the Customs Convention on Containers (CCC): Algeria, Armenia, Australia, Austria, Azerbaijan, Belarus, Bulgaria, Burundi, Canada, China, Cuba, Czech Republic, Finland, Georgia, Hungary, Indonesia, Kazakhstan, Kyrgyz Republic, Lebanon, Liberia, Lithuania, Moldova, Montenegro, Morocco, New Zealand, Poland, South Korea, Romania, Russia, Saudi Arabia, Serbia, Slovakia, Spain, Switzerland, Trinidad and Tobago, Tunisia, Turkey, Ukraine, the United States, Uzbekistan.

Related subjects:

- International Maritime Organization

- Istanbul Convention

- TIR Convention

- International Road Transport Union (IRU)

- Safe Load Securing for Road Transport

- International Union of Railways

- International Chamber of Shipping

- IATA

Source: International Bureau of Containers and Intermodal Transport

ILU Code (Road-Rail Combined Transport).

(c) EENI Global Business School (1995-2025)

Top of this page

WhatsApp

WhatsApp